India is no longer just a cost-efficient back office for the life science and Healthcare industry. It’s quietly but decisively becoming the strategic nerve centre for global pharma innovation. Over the past few years, the country’s life sciences hubs have evolved into high-value engines, delivering capabilities in R&D, data science, digital health, and AI that rival or even exceed those at corporate headquarters.

From Support to Strategy

India’s evolution as an innovation hub is driven by three forces: deep digital maturity, a thriving startup ecosystem, and policy-level momentum that actively supports R&D, manufacturing, and infrastructure expansion. These strengths enable robust capabilities across AI, cloud, analytics, and accelerating R&D, making India a natural location for global capability centres (GCCs) focused on healthcare innovation.

Digital Infrastructure and STEM Talent Powering Pharma GCC Growth

India’s digital backbone, built on its IT legacy, gives GCCs a solid platform to scale AI, analytics, cybersecurity, and cloud operations. With 18 Mn STEM graduates expected by 2027, the talent pipeline is both vast and future-ready. The Digital India initiative has expanded connectivity across Tier-1 and Tier-2 cities, enabling seamless operations.

Healthcare now makes up over 15% of India’s GCC workforce, giving global firms access to digital-first, analytics-ready talent. Indian centres now lead in decision-making, experimentation, and platform innovation – not just execution.

HealthTech Startups and GCCs: Accelerating Pharma Innovation Together

India has already solidified its position as the third-largest startup ecosystem globally with 1,70,000 DPIIT-recognised startups, evolving from external innovators to co-creators. GCCs team up with startups to address complex R&D and patient engagement needs faster. Novartis Biome India partners with health tech startups to tackle real-world clinical and commercial problems—an agile, scalable model aligned with global drug development goals.

Global Pharma’s Long-Term Investment in India’s GCC Ecosystem

Several global pharma and MedTech players have committed long-term to India’s GCC ecosystem:

- Sanofi is investing €400 Mn in its Hyderabad hub by 2030, doubling headcount to over 2,600 by 2026 and focusing on data science and clinical research.

- Takeda opened its Innovation Capability Centre in Bengaluru in 2025 to lead platform design in patient engagement and early-stage automation.

Several global pharma and MedTech players have committed long-term to India’s GCC ecosystem:

- Novartis’s Corporate Centre in Hyderabad plays a critical role in managing clinical trial operations and regulatory submissions that directly shape global R&D timelines.

- AstraZeneca’s Global Business Services (GBS) centre in Bengaluru, along with its Innovation Capability Centre in Bengaluru in 2025 to lead platform design in patient engagement and early-stage automation.

- Roche’s Digital Centre of Excellence in Pune leads advancements in personalised diagnostics and AI-powered models as part of its precision medicine strategy.

- Eli Lilly’s GCC in Bengaluru continues to expand its impact through automation, scalable data platforms, and digital trial capabilities, accelerating clinical execution globally.

Collectively, these GCCs are no longer peripheral units, they are deeply embedded innovation hubs delivering strategic outcomes that influence global headquarters’ direction and speed of execution.

Policy-Driven Growth: How India Enables Scalable Pharma GCCs

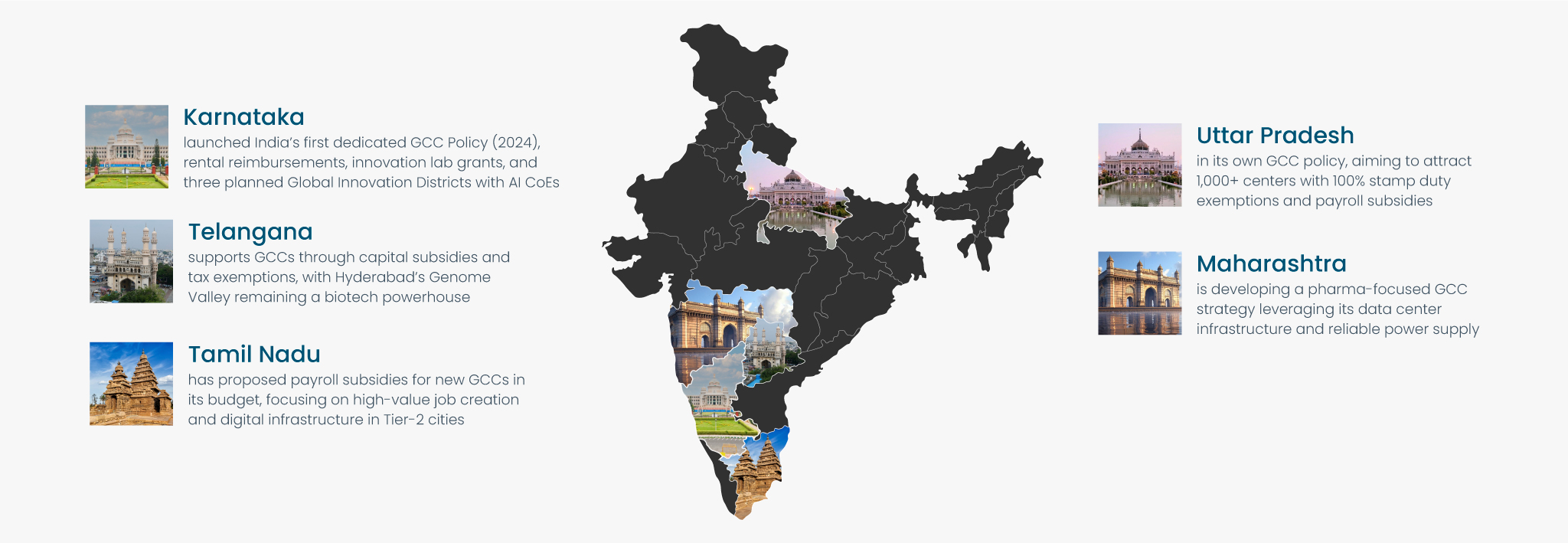

And then at the state level, proactive policies are making a difference:

To support growth beyond the traditional hubs, Meit-Y is developing a new framework to incentivise GCCs in Tier 2 and Tier 3 cities. This aims to unlock untapped talent pools, reduce geographic concentration risks, and catalyse regional innovation ecosystems, crucial for sustaining India’s global leadership in pharma innovation.

India’s Value Proposition: From Cost Efficiency to Innovation Depth

While India’s cost advantage in operations remains attractive, it’s no longer the main story. The real value lies in its mature innovation ecosystem. Global pharma leaders aren’t outsourcing – they’re building. India now hosts core functions that drive digital health, regulatory agility, and accelerated R&D. As healthcare shifts to patient-centric, digital-first models, India isn’t following trends – it’s setting them.

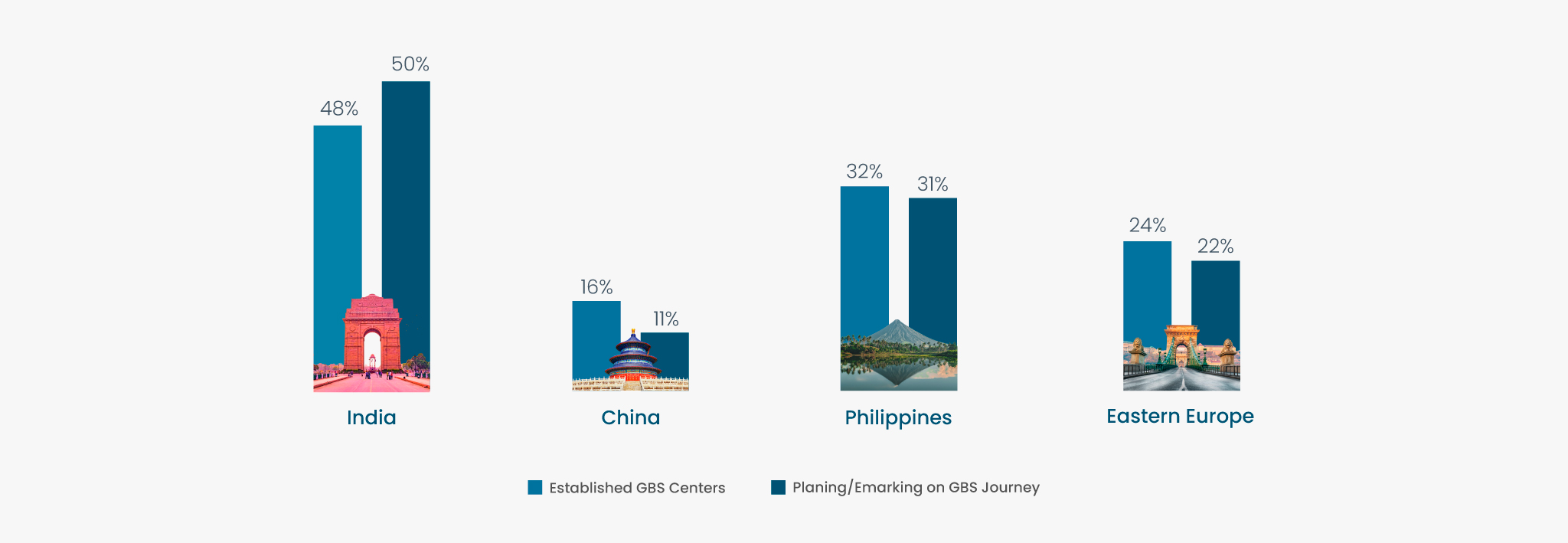

Global GBS Outlook: India Leads in Established and Emerging Centres

India stands out as the top destination globally, with 48% of established GBS centres and 50% of planned expansions, underscoring its dominance in both maturity and momentum. The innovation hubs aren’t emerging – they’ve arrived. The question isn’t why India anymore. It’s how fast can you build.

Insights That Drive Impact

Healthcare is evolving faster than ever — and those who adapt are the ones who will lead the change.

Stay ahead of the curve with our in-depth insights, expert perspectives, and a strategic lens on what’s next for the industry.