Things are looking up for the Life Sciences industry as 2023 recorded an increase in novel drug approvals, M&A activity, and R&D spending

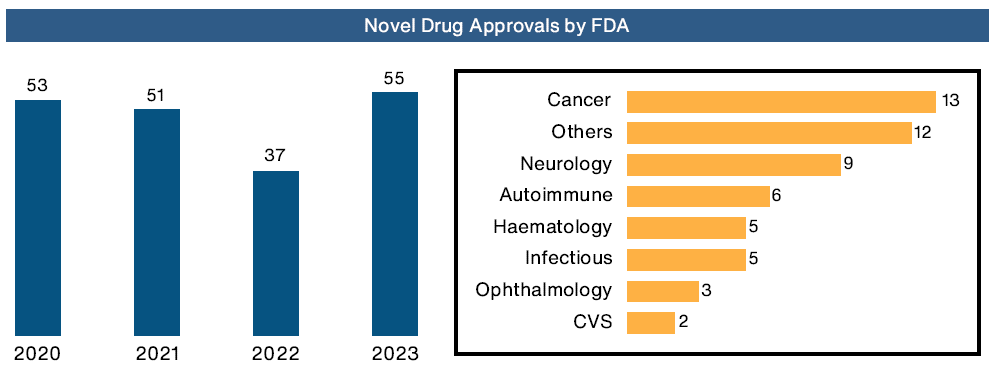

AHMEDABAD, GUJARAT, INDIA, February 22, 2024- 2023 marked a remarkable year for the Life Sciences and pharmaceutical industry, from novel drug approvals, significant M&A activity to increase in R&D investments. The industry witnessed a surge in FDA approvals, with 55 new drugs gaining regulatory clearance — a 50% increase from the previous year. Cancer treatments dominated the approvals in 2023, with 16 new drugs in the area of Oncology treatment. Gene therapies, particularly those for sickle cell disease, saw historic approvals, with Casgevy and Lyfgenia receiving the green light on the same day. RSV vaccines emerged as a significant development, with GSK, Pfizer, Sanofi, and AstraZeneca gaining approvals for various products.

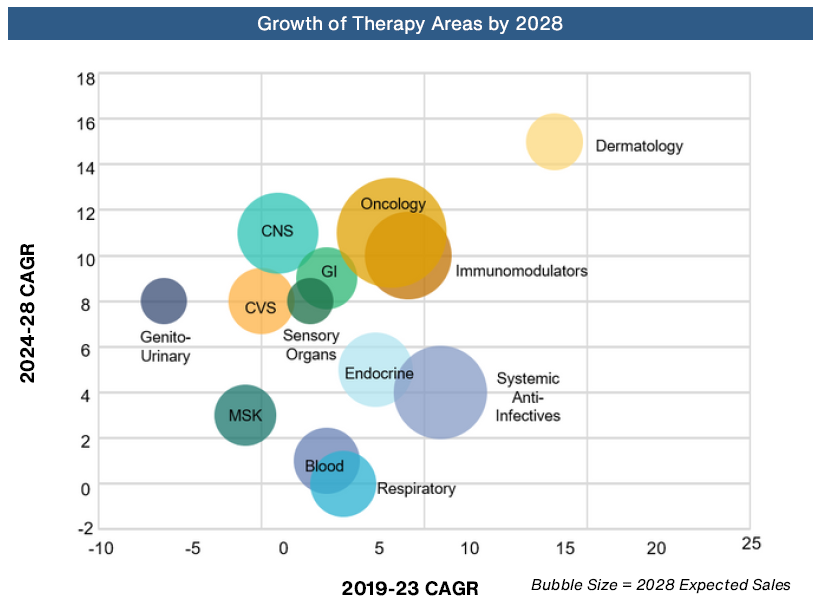

As Healthark’s report on ‘Top 10 Life Sciences Trends of 2023’ rightly captures, the focus on innovation has increased across various therapeutic areas, addressing critical conditions such as Alzheimer’s, Cancer, and Rare Genetic Disorders. Though Oncology remains a dominant force in the pharmaceutical industry, Obesity and the Central Nervous System (CNS) disorders have emerged as fresh growth frontiers for Big Pharma. Novo Nordisk’s Wegovy and Eli Lilly’s advancements in oral drugs for obesity have signified a paradigm shift in public perception. CNS has seen renewed interest following new treatments for Parkinson’s and Alzheimer’s disease such as FDA approval of Biogen & Eisai’s Aduhelm and Eli Lily’s Legembi.

In a decade marked by dynamic advancements, Antibody-Drug Conjugates (ADCs) are predicted to have a soaring market worth exceeding $36 Bn by 2029. With 13 new launches since 2017 and strategic collaborations, ADC technology is becoming a hotspot for innovation, exemplified by the record-breaking $43 Bn deal between Pfizer and Seagen and the $10 Bn deal between AbbVie and Immunogen. Cell and Gene Therapy has been under the limelight with a promising end-stage pipeline and investments to transform patient outcomes with ~75% of Phase I–III gene therapy trials focusing on oncology and genetic disorders.

Deal-making in the life sciences sector in 2023 surpassed expectations, with the pharmaceutical industry witnessing $163 Bn worth of deals — an impressive 35% increase compared to 2022. Pharmaceutical companies have demonstrated resilience to the impact of elevated interest rates and inflation whereas MedTech and diagnostics experienced a decline as companies focused on portfolio rationalization and cost transformation. Some noteworthy deals include Pfizer and Seagen ($43 Bn), Bristol Myers Squibb and Karuna Therapeutics ($14 Bn), and Merck and Prometheus Biosciences ($11 Bn). The increased M&A activity is speculated to be a result of increased competition in the industry and the growing demand for multi-indication pharmaceutical products.

As pharmaceutical Research and Development (R&D) spending grows steadily, the industry focuses on innovation with speed, scale, and affordability. The integration of Artificial Intelligence (AI) in the life sciences industry has witnessed a significant surge, with more than 100 AI-based collaborations in 2023 alone for targeted drug discovery, clinical trials, and diagnostics. Asia-Pacific has emerged as a promising market for clinical trials, with ~50% of clinical trial locations globally due to the region’s larger urban population and favorable environment for biotech R&D. Amid the impending patent cliff of 190 drugs, biosimilars have gained traction, with more than 100 biosimilars in development to overcome the effects of patent expiry.

Despite the strides in innovation, the pharmaceutical industry is grappling with the challenge of drug price hikes until the commencement of Medicare Price Negotiation in 2026 highlighting the industry’s need to address concerns surrounding drug affordability and accessibility.

Looking ahead to 2024, mergers and acquisitions are expected to continue booming with an anticipated growth of 30%, bringing total value to ~$ 200 Bn. With Bipartisan Legislation, out-of-pocket spend per retail prescription is expected to decrease by 10%. AI-based platforms will continue to dominate clinical development, with at least 30 drug candidates in active clinical development programs.

“Life Sciences companies will continue to adopt and transform through digital technologies in the face of ever-changing regulatory dynamics and volatile markets. With the right strategies and capabilities in place, life sciences companies will be able to register the expected growth, while delivering value to patients, health care providers, and other stakeholders.”

About Healthark

Healthark is a global management consulting firm developed by a team of experts from diverse fields such as consulting, pharma, medicine, medical devices, digital health, public health, and management with a common vision to cater to the healthcare and life sciences industry, along with a relentless focus on delivering executable solutions.

Healthark team helps customers make critical decisions every day through expertise that combines deep domain knowledge, rigorous research, and analysis, understanding of markets, technology, and experience. With the right experience and expertise, the team not only provides insights but also works closely with clients to execute the strategy that they have helped develop.

About Healthark Top 10 Research Report Series

Healthark annually tracks the top events and trends in the healthcare and life sciences industry, and publishes reports at the end of each year summarizing the top 10 trends in healthcare industry, life sciences industry, health tech, the top 10 innovations and drug approvals and so on, with an objective of summarizing the key events and industry shaping forces during the previous year, and shares a view-point on how the sector will evolve in the coming year.