Healthcare Is Shifting From Hospital To Home

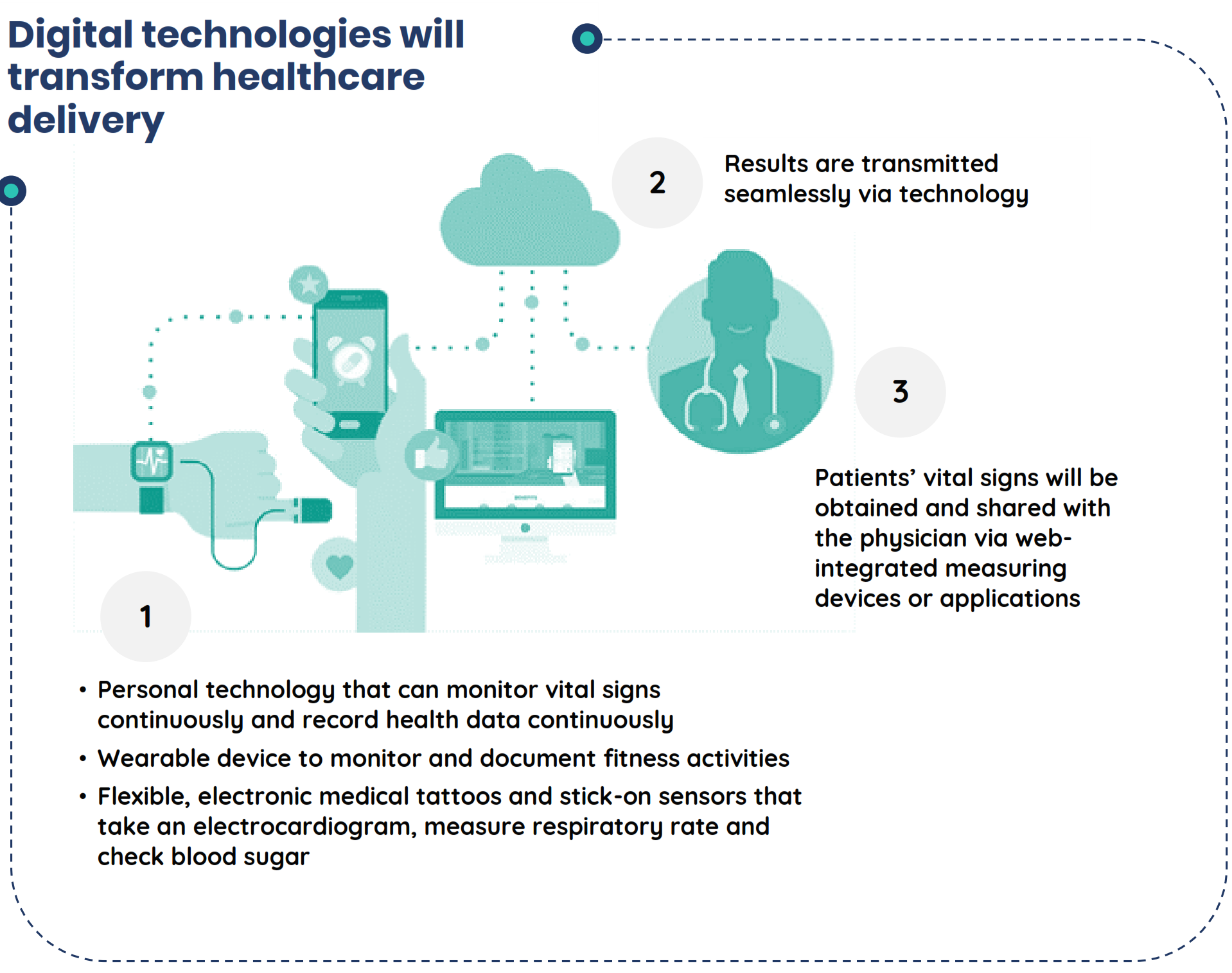

The evolution of healthcare has been a remarkable one: what was a time-consuming process for patients availing services at a clinic or hospital, is now an on-demand, instant service delivered to the patient’s doorstep! Delays, queues and waiting times to get an appointment with the doctor have now been replaced by prompt and user-friendly Tele-consultation and Telemedicine platforms. On-paper medical records that would often be lost or outdated or rife with mistakes, have now become electronic, automated, and easily maintained. Basic healthcare and treatment, access to which was once unimaginable for the remote population, has now become highly accessible and democratized. Complementing the developments in healthcare, there is also technology in place that can help patients and caregivers monitor vital signs round the clock. Sensors and wearable devices that record a patient’s SPO2, heart rate, breathing, blood pressure, sleep patterns etc. are widely used now. These revolutions in this space are taking place holistically across the entire health ecosystem. Biometric data collected from the devices is not just for the patients’ knowledge but can be seamlessly transferred via Bluetooth or cloud to the physician and systematic intervention can be provided. This data can further be used for medical research or as a dynamic database to power AI and associated platforms. It is, thus, prudent to invest in Health-tech and big data, as leveraging this information is vital to the future of healthcare.

Use Cases – Digital health tools can lead to better outcomes

Abilify MyCite

It is a small pill which contains a sensor that can transmit information directly to a mobile phone of the patient and the physician and helps ensure patients’ compliance to prescription.

Target Indication

Schizophrenia, acute treatment of manic and bipolar disorders

Approvals

Food and Drug Administration

Bluestar Software

A noteworthy software focused on management of diabetes type 1 and 2 patients. It takes a holistic approach to managing diabetes, by syncing pharmacies, fitness bands and health trackers with glucose meters

Value Proposition

- All the data and insights gathered by the software are cascaded to the user’s care-providers, making it easier for them to review, compare and analyze the patient’s medical data along with his medical history stored in the cloud

- It can be tailored to the user’s specific needs and is helpful in getting help 24/7 should it be required

Target Indication

Type 1 and Type 2 diabetes patients

Approvals

Food and Drug Administration

Smart Contact Lenses

They detect the level of glucose in tears and give a reading of the body’s sugar levels in diabetics.

Virtual Reality

Software enables simulation of operative environment

Triggers For Adoption Of Digital Health Solutions

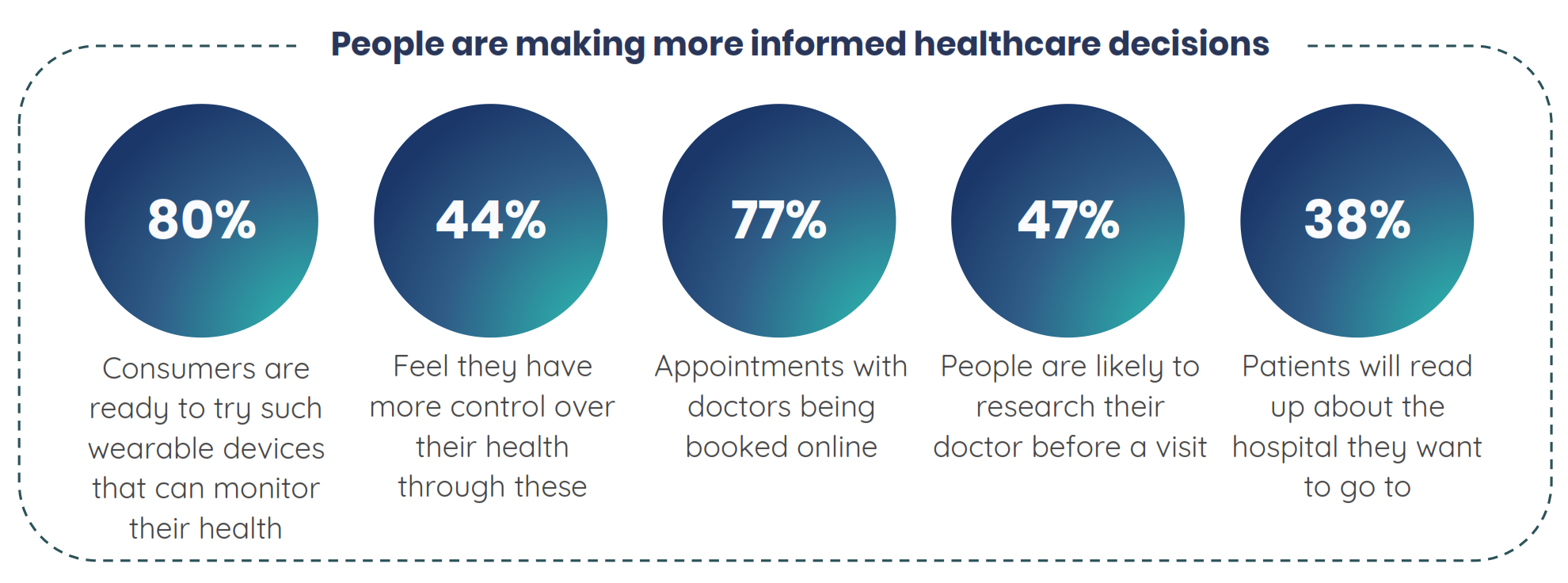

The digital health’s market size of $106 billion in 2019 is expected to grow by 6.03 times, by 2026, to a whopping $639 billion. Wearable health devices will grow in the market for a share of $22 billion by the year 2025, a mighty leap of 80 times from 2015.

Three factors driving the digital health market

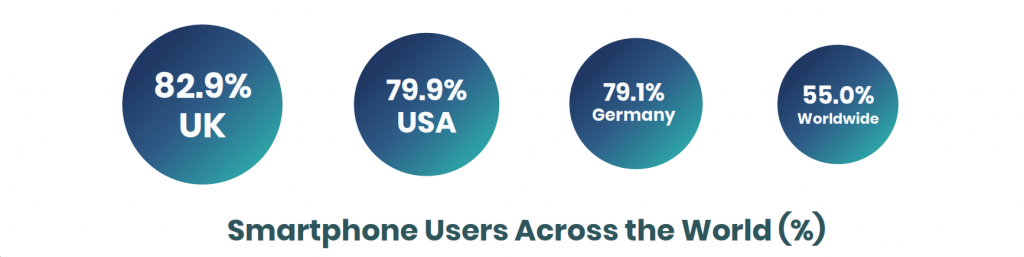

Smartphone usage has become the norm and has made information easy to access. Advanced technologies such as IoT and AI can be applied to various sectors of patient care to develop products. Use of mobile health technologies to monitor their chronic diseases by patients themselves, and keep them in check, E.g. for diabetics

With sedentary lifestyle trends on the rise and a larger population slipping into obesity and consumption of adulterated foods leading to more diabetes cases, the chronic disease burden by 2020 will have risen by 57%. However, people are also becoming more aware of the importance of preventive care and its long-term benefits in saving healthcare costs in the future

Investment in healthcare has become a lucrative opportunity with investors pouring in $13.7 billion in 2019, and it was the second highest funded year ever. The most focused-on sector is Telemedicine, which saw a funding of $1.7 billion, followed by Analytics and mobile health. Other categories which were also well-funded in 2019 are booking apps, clinical decision support portals etc.

DIGITAL THERAPEUTICS (DTx)

Digital Therapeutics are software products that deliver evidence-based interventions to improve, manage or treat a medical disease. DTx are narrow spectrum and tightly regulated interventions that can manage or cure a disease. These need to be evidence-based with extensive research to show their efficacy. Proof of their success in clinical trials and in everyday practice has to be shown in order to decide their indications, contraindications, risk and benefits.

Digital health solution companies do not need clinical evidence or regulatory oversight to launch their product in the market. But there is a subset of Digital health – Digital Therapeutics which is regulated, requires clinical evidence and real-world outcomes in order to launch their product / services to improve people lives.

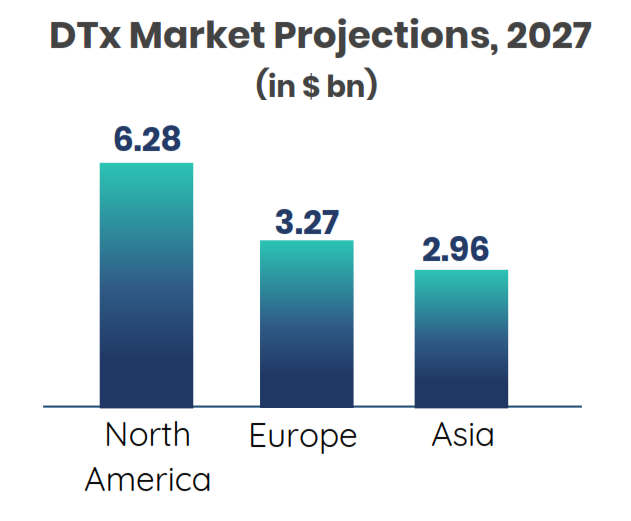

The market for digital therapeutics was 2.9 billion USD in 2019, and is expected to grow to 13.8 billion USD by 2027. Some of the largest investments were seen in diseases such as diabetes management, cardiovascular disorders, and obesity.

There are two models of work in digital therapeutics: one is Business-to-business (B2B), and the other is Business-to-Consumer (B2C). In B2B, we see manufacturers supplying their products to healthcare facilities, wellness centers, gyms etc. In B2C, products are sold directly to the consumer. The B2B model is projected to reach $5.61 billion by 2027, while B2C would reach $8.9 billion by the same year.

Top Companies in the Digital Therapeutics Market

Coming to some of the top companies that are key players in the digital health and therapeutics space, the first one is Voluntis. It was founded in 2001, primarily focused on patients with diabetes and oncology related issues. They manage chronic conditions and try to improve the treatment outcomes. They have collaborated with Biocon Biologics to innovate on digital therapeutics for insulin. They also have a software called Oleena which has successfully completed its FDA regulatory review, and is used for remotely monitoring cancer patients for related symptoms. Oleena gives personalized recommendations to cancer patients based on the symptoms they enter into the app, and patient can self-manage their symptoms. However, when the severity of the condition becomes too much for the patient to handle by themselves, the app connects them to the medical assistance team, and the app continues monitoring the patient till the symptom has resolved. Apart from this, Voluntis has created other products such as Insulia, Diabeo, CoacguCheck, Theraxium Oncology etc.

It was founded in 2011 and creates online digital programs which monitor individuals at risk of chronic illness. It combines behavioral data and data science for type 2 diabetics. Omada initially launched the platform to guide patients with chronic health conditions through the process of changing their behavior to improve their health, with the help of tracking tools and informational guides for weight management, daily activity levels, etc. Now the company has transformed its health hub into a one-stop shop encompassing the entire spectrum of virtual care. Omada offers a slew of digital coaching programs addressing hypertension, Type 2 diabetes, mental health conditions and other health needs. It has implemented connected technology to track participants and hold them accountable – a wireless scale, a pedometer, and a mobile app to track food and activity for its diabetes program.

ResMed Inc. has a significant presence in the respiratory disease market. It uses cloud computing and medical devices to manage and treat sleep related breathing disorders such as sleep apnea. They have a wide variety of products and services, such as Propeller Health, which is a software program attached to inhalers that detects usage pattern of inhaler- frequency, compliance and breathing patterns of the patient through attached sensors. It is used in the management of asthma and chronic obstructive pulmonary disease. Other products include ‘myAir’ which tracks sleep therapy progress, and AirView, for Obstructive Sleep Apnea patients.

![]()

The company was started in 2008, which aims to provide clinically validated software solutions which are therapeutic for patients and help them improve their prognosis, gaining more engagement and compliance from them, and also allowing clinicians to track the patients’ status. They have made products such as ‘reSET’: it is the first FDA authorized Prescription Drug Therapeutic (PDT), that helps enhance disease prognoses, and is a 90-day PDT for patients suffering from Substance Use Disorder. It is indicated for provision of Cognitive Behavioral Therapy (CBT), along with the usual contingency plans and drug regimens prescribed to manage the condition in an outpatient setting. The ‘reSET’ system has a portal where the patient can record the lessons completed, get rewards for compliance, keep a record of their cravings or triggers and the storage of simultaneous data such as in clinic drug test reports.

Along with such revolutionary products, Pear Therapeutics has also come up with solutions like Pear – 003 (for Insomnia and Depression), Pear – 006, for Multiple Sclerosis and ‘reSET-O’ for Opioid Use Disorder. It has collaborated with Novartis to launch ‘reSET’ and ‘reSET-O’.

![]()

It was founded in 2014 and is focused on diabetes management by providing patients with tools and coaching. The Livongo Diabetes Meter is a pretty nifty device that logs your blood glucose levels directly into the meter through pre-ready strips that come in the packaging. The device stores your glucose readings and gets you in touch with a certified diabetes management expert should your reading go too low or high, or if you’re feeling under the weather. They provide tips and advice on how best to manage your blood sugar levels day to day and spare the hassle of unnecessary doctor’s visits and wastage of time. The data is uploaded and synced on cloud. The company has been acquired by myStrength, Inc.

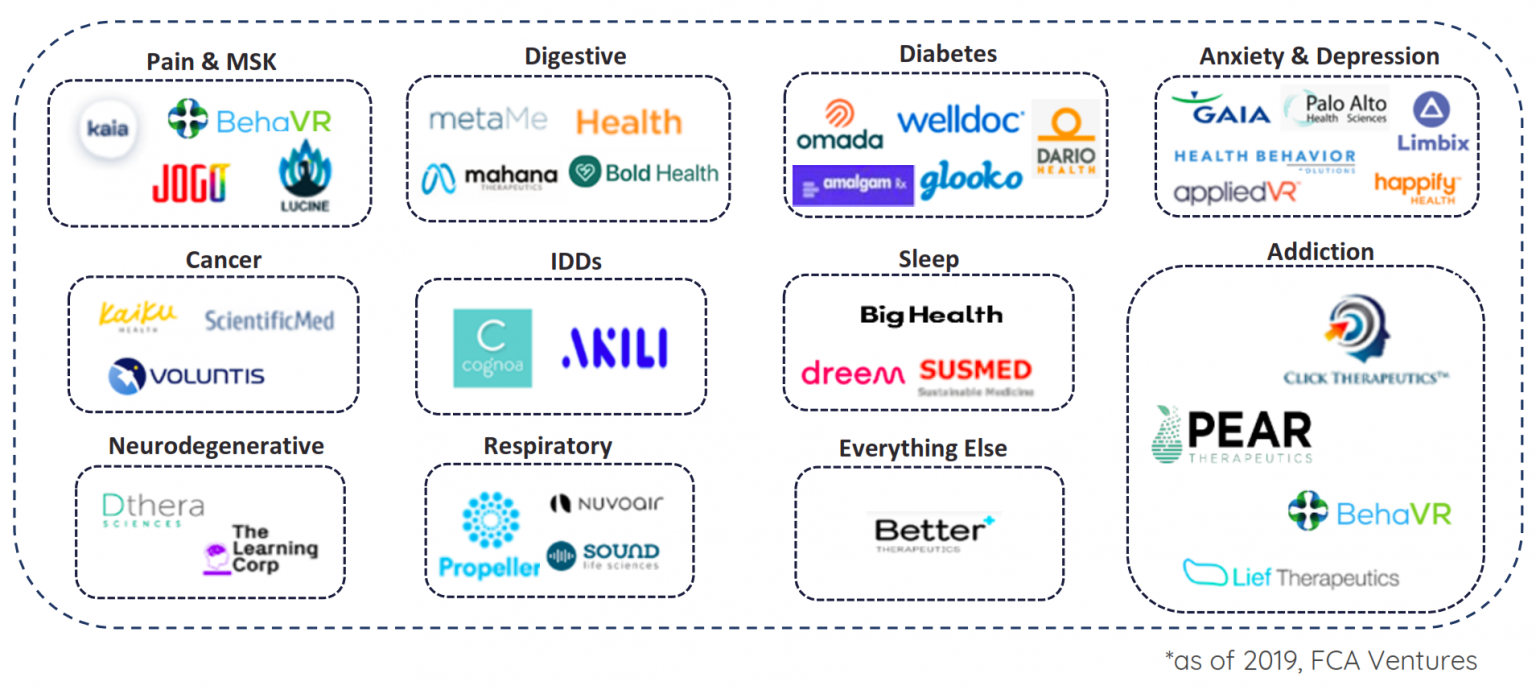

Digital therapeutics can cover a wide spectrum of diseases

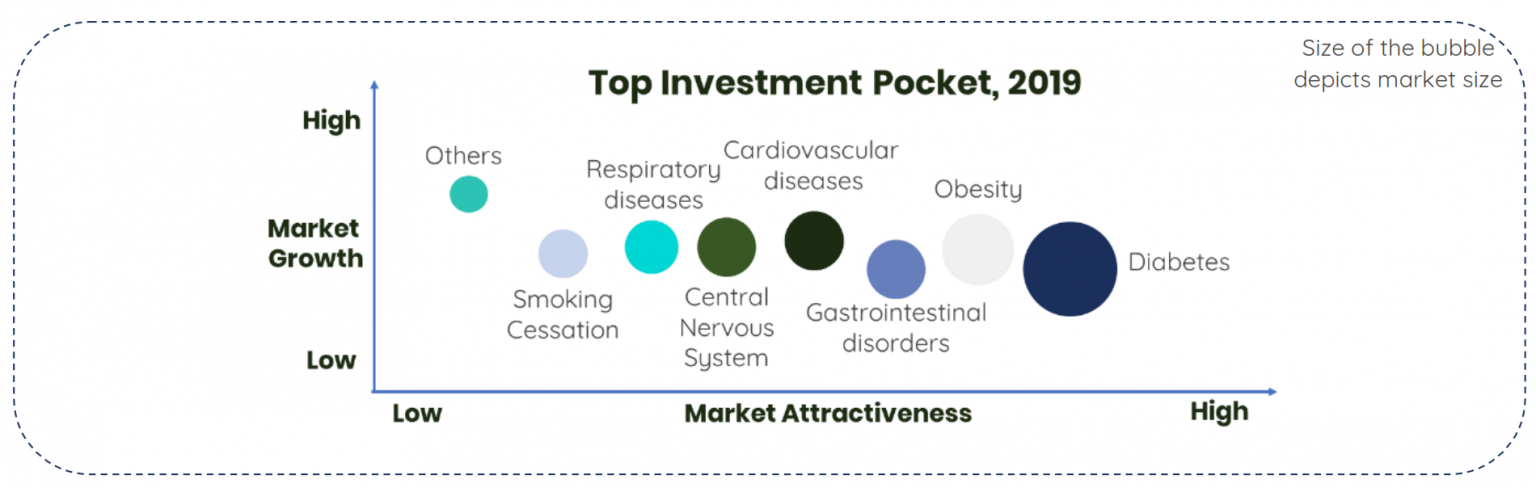

The disease which takes up a large chunk of the market in digital therapeutics is diabetes, especially in regions such as the Middle East, North America, and North Africa. In Asia, it is pretty common in India – which is known as the ‘diabetes capital of the world’. Through 2020-2027, the share of diabetes in digital healthcare will increase by a CAGR of 20.5%. The compound annual growth rate of obesity will be 23.5% in the same time period, with USA having the lion’s share of the market. Obesity will contribute $1.01 billion by 2027 and will grow at a rate of 22.7% from 2020-2027. Next comes cardiovascular disease, which is one of the leading causes of death worldwide. It has been shown that 90% of cardio related deaths are preventable just by monitoring health related data through wearable devices and integrated platforms. Here also, North America dominates the market of cardiac disease burden. Apart from this, North America has the highest cases of gastrointestinal and central nervous system disease share in the digital therapeutics market. The central nervous system disorders digital therapeutics market is expected to grow at a CAGR of 19.7% during 2020-2027, and GI disorders digital therapeutics at 16.6% during the same period. The burden of respiratory disease digital therapeutics is also highest in North America, valuing at $161 million in 2019, and is expected to grow at a CAGR of 20.5% between this seven-year period.

Key Players operating in Digital Therapeutics*

Investment and funding landscape in Digital Therapeutics

When we look at the investments by disease areas, chronic conditions like Diabetes and Obesity come out as the most attractive investment areas. Mainly due to rising global burden of chronic conditions combined with the fact that several DTx companies are focused on developing medication adherence and lifestyle / behavior management solutions.

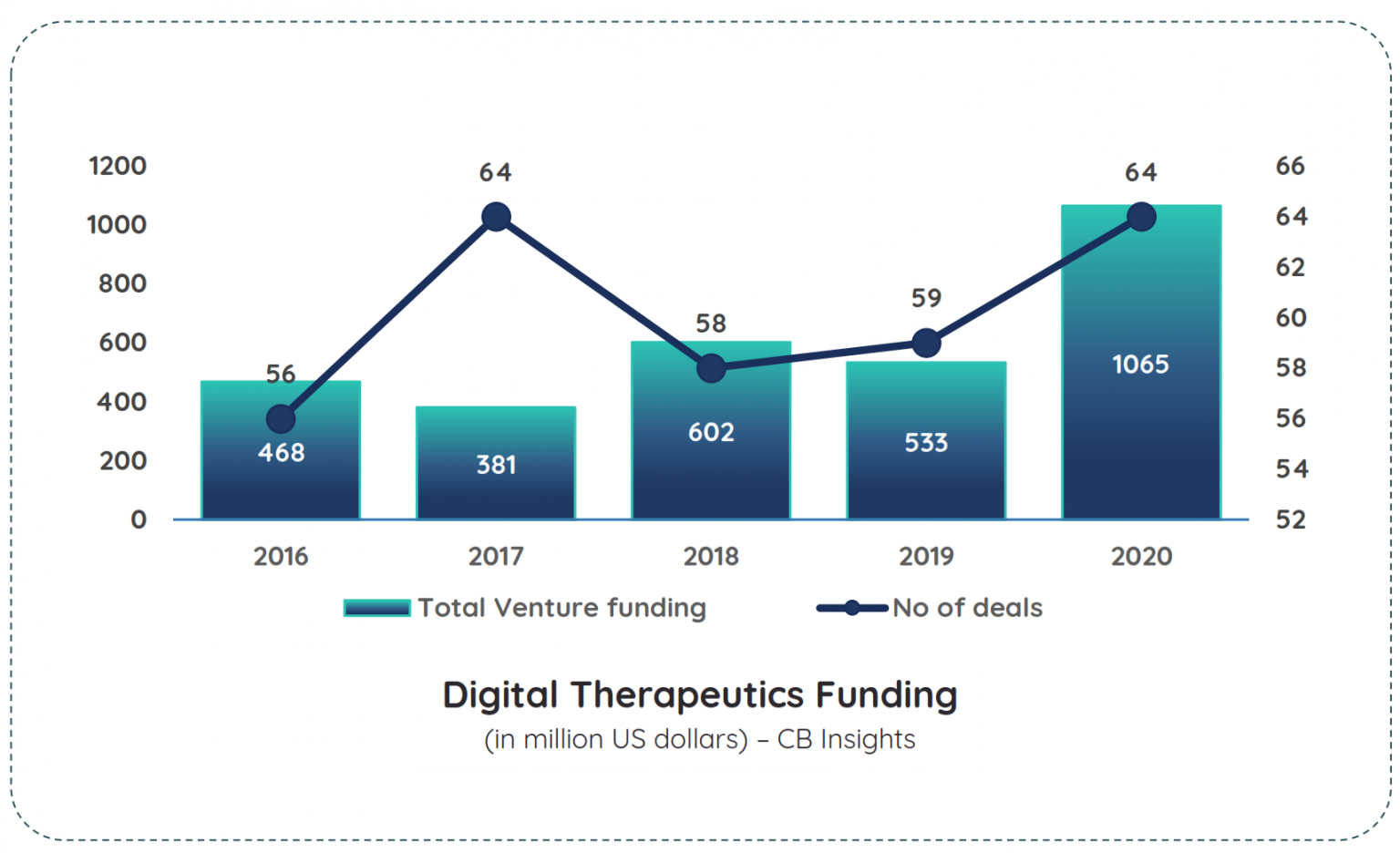

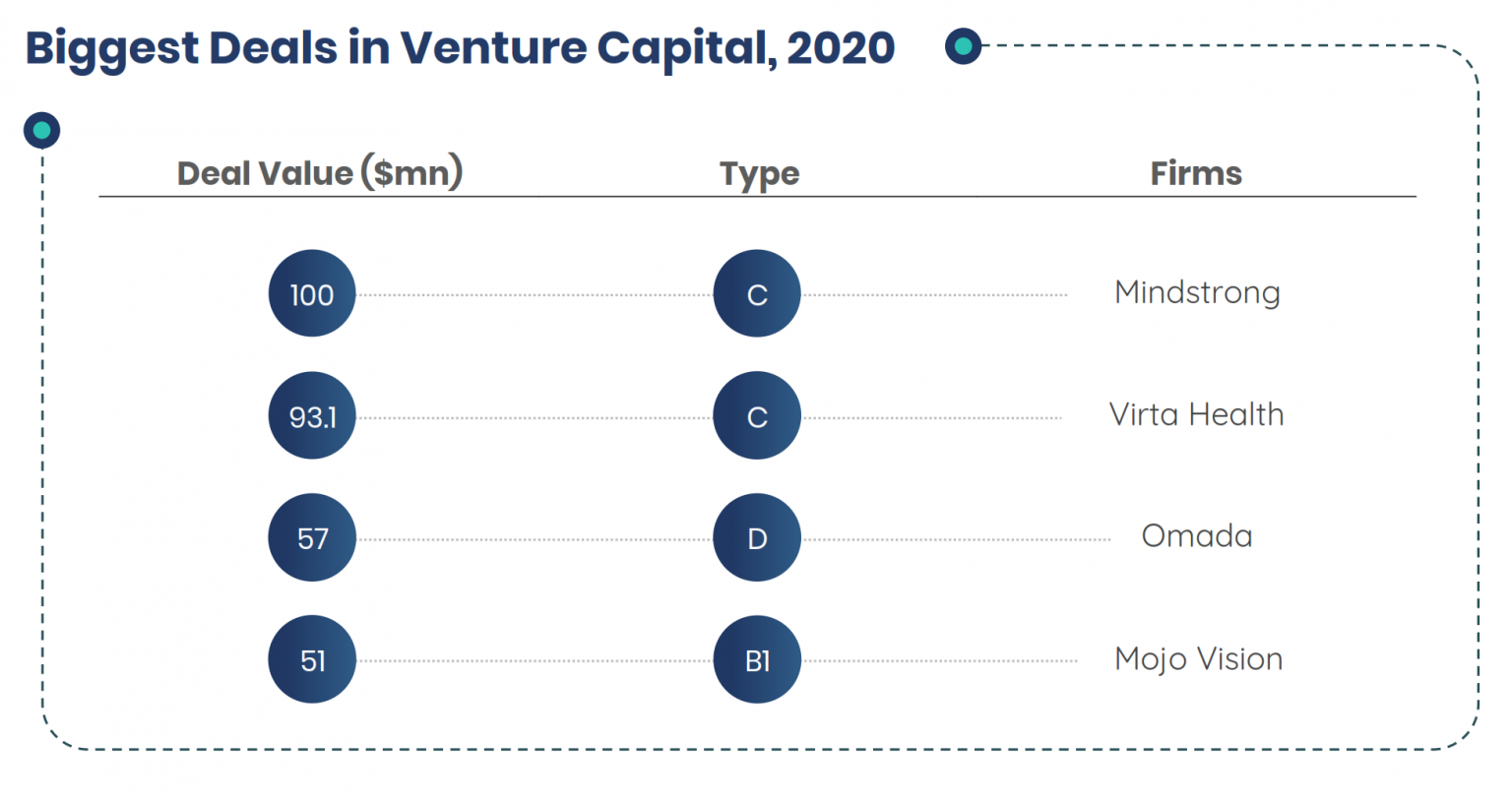

Digital therapeutics raised record funding in 2020

Investments in DTx were at a record $1,065 million with 64 deals in 2020. In 2019, $533 million were invested across 59 deals, up from $468 million in 2016 for 56 deals.

Active investors in the digital therapeutics market include Spectrum Health Ventures, Lead Edge Capital, Providence Ventures, RRE Ventures, US Venture Partners, Bronze Venture Capital and M2.

Investments in digital therapeutics have more than doubled from 2016 – 2020

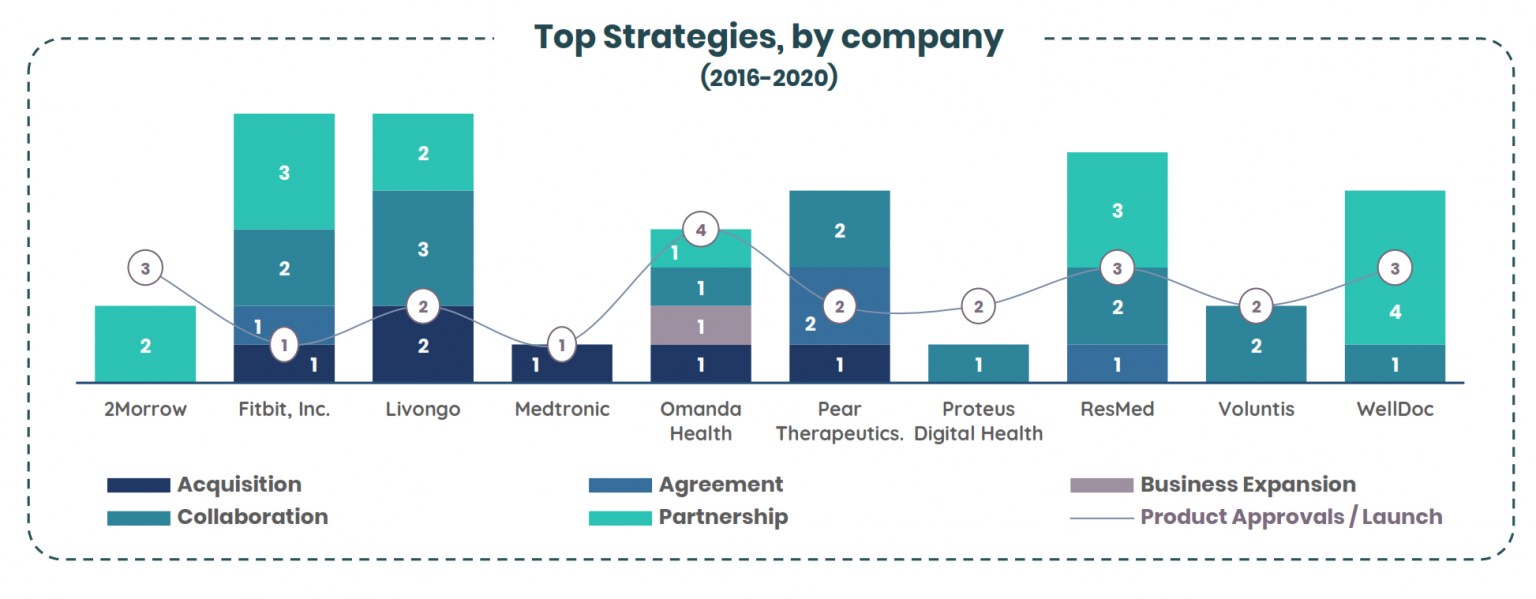

Companies have largely collaborated or partnered with Big Pharma companies to launch new products in the market

There are many more such big names in the industry, and they partner up or collaborate on numerous products to access the chunk of market that the other company caters to

- ResMed has a wider distribution network and a bigger variety of products, more investment and greater geographical presence.

- The company Fitbit has access to more than 87 countries, with its wearable devices being popular for fitness.

- Livongo Health also dominates the market as a key player in terms of market penetration, R & D, and capital investment. It has a formidable presence in computer platform as well as smartphone applications.

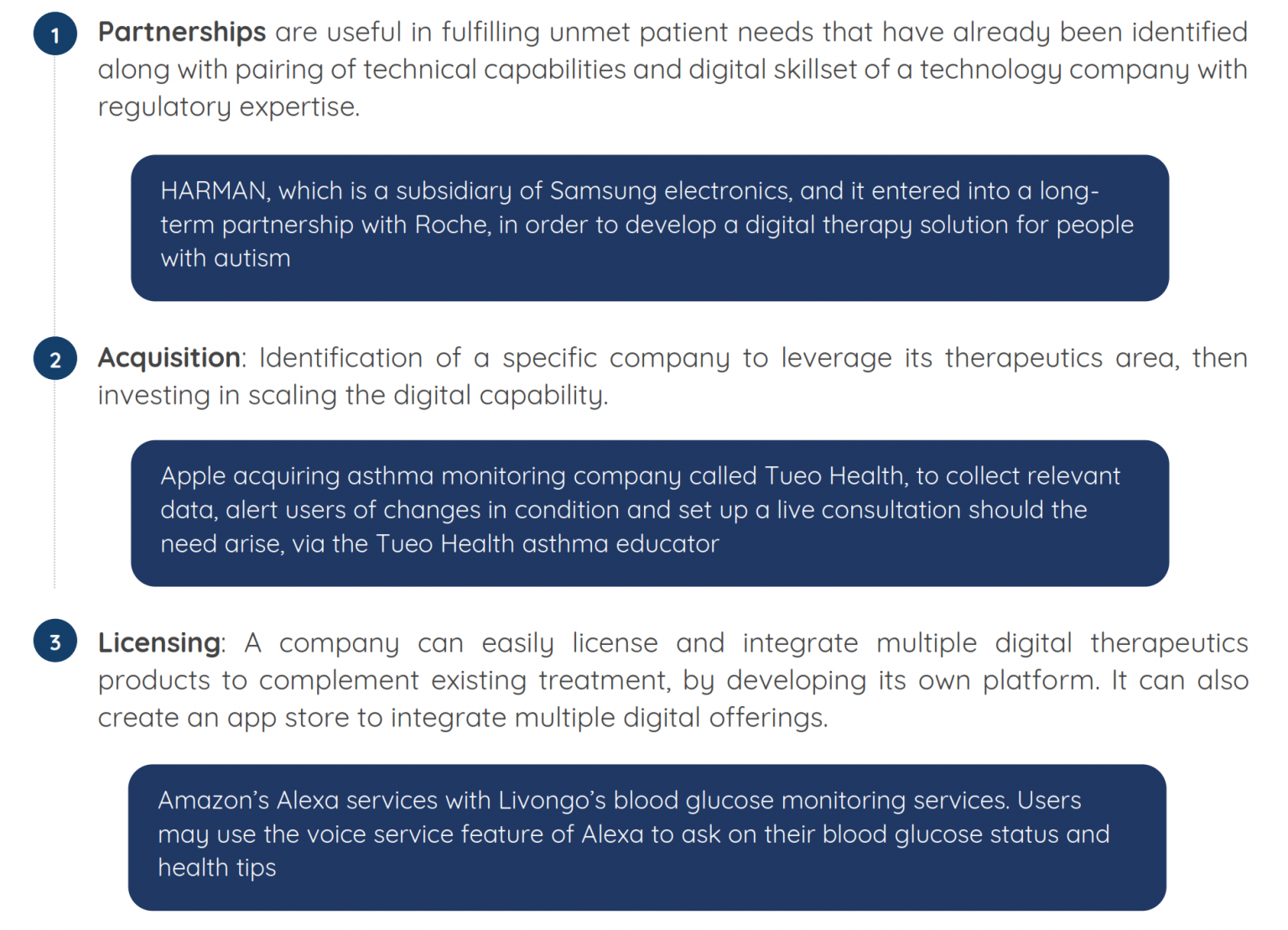

Partnerships

- Propeller and Orion partnered up in 2019 to bring new digital therapies for patients with COPD and asthma. It connects Orion’s already existing Easyhaler line of inhalers with Propeller’s digital medicine platform via a small sensor.

- Happify health and Sanofi teamed up in 2019 to explore digital therapies for people with depression and multiple sclerosis.

Acquisitions

- The company Biofourmis moved to acquire Gaido Health, which places them in a strong position to venture into the Oncology space of DTx. Their joint ventures aim to monitor post-discharge cancer patients and manage their symptoms after leaving hospital.

- The company Virgin Pulse acquired Blue Mesa, which is best known for its diabetes prevention program called Transform.

- The Swiss pharmaceutical company Novartis acquired the digital therapeutics firm “Amblyotech” that provides a novel digital therapy for treatment of amblyopia. This acquisition moves Novartis further into the refractive disorder line in ophthalmology. The software utilizes video gaming with 3D glasses, which trains the patient with lazy eye to use both eyes simultaneously to view the images as a whole. The software uses something called ‘dichoptic display’ where an algorithm presents each eye with different images.

- Recently, CVS health also announced that they had added five new companies to their digital health platform for PBM clients, including Hinge Health, Livongo, Hello Heart, Torchlight and Whil.

Other Strategies

- Akili launched a product in 2020, EndeavorTM, which is aimed for children with ADHD, and is an action-based video game shown to improve concentration and attention.

- MedRhythms in 2020 announced that they were developing a Patent Advisory Board, which is the first of its kind in the industry. This will bring a patient’s perspective into decisions that motivate the company’s goals, vision and products, through the lens of living with the effects of Parkinson’s, MS and strokes.

- Pear Therapeutics also announced a limited distribution program for its product, Pear – 004, for management of people living with schizophrenia.

- Big Health launched a CBT based app called DaylightTM, which focuses on combating and reducing feelings of anxiety.

Partnership, by far, remains the best strategy for growth, closely followed by collaboration, product launch, product approval, acquisition, agreement, and business expansion

Regulation

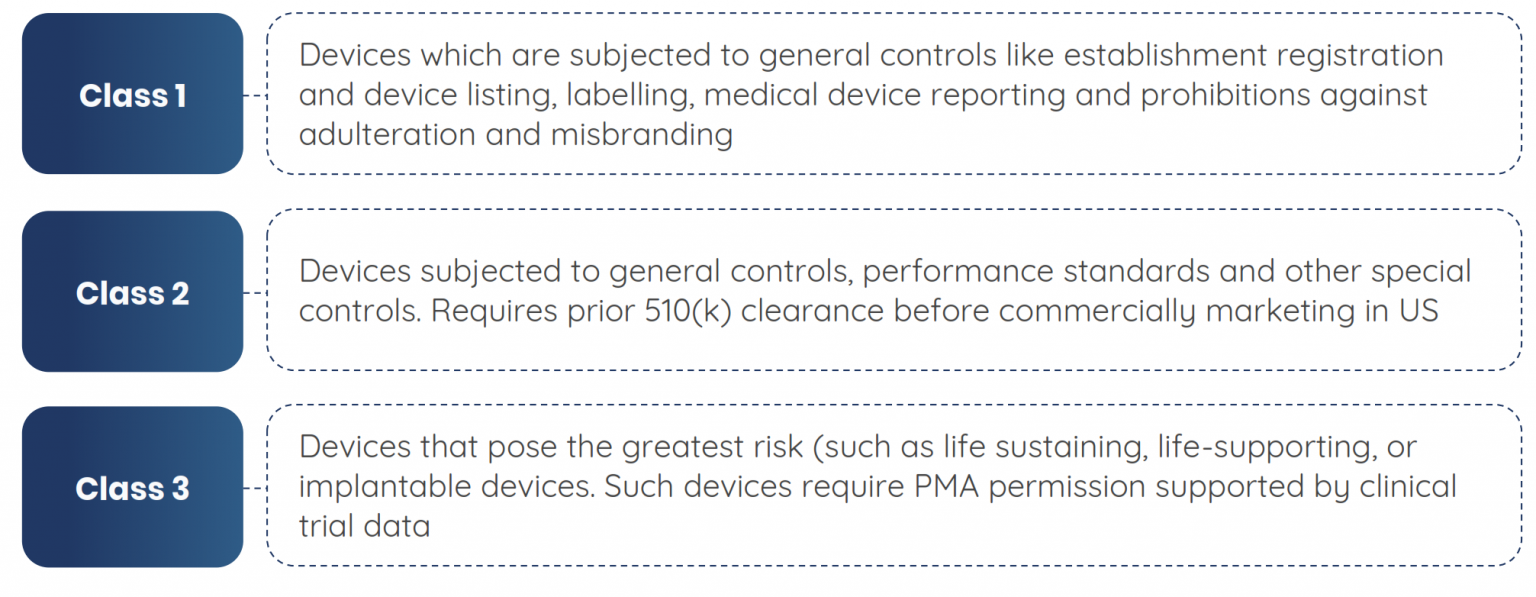

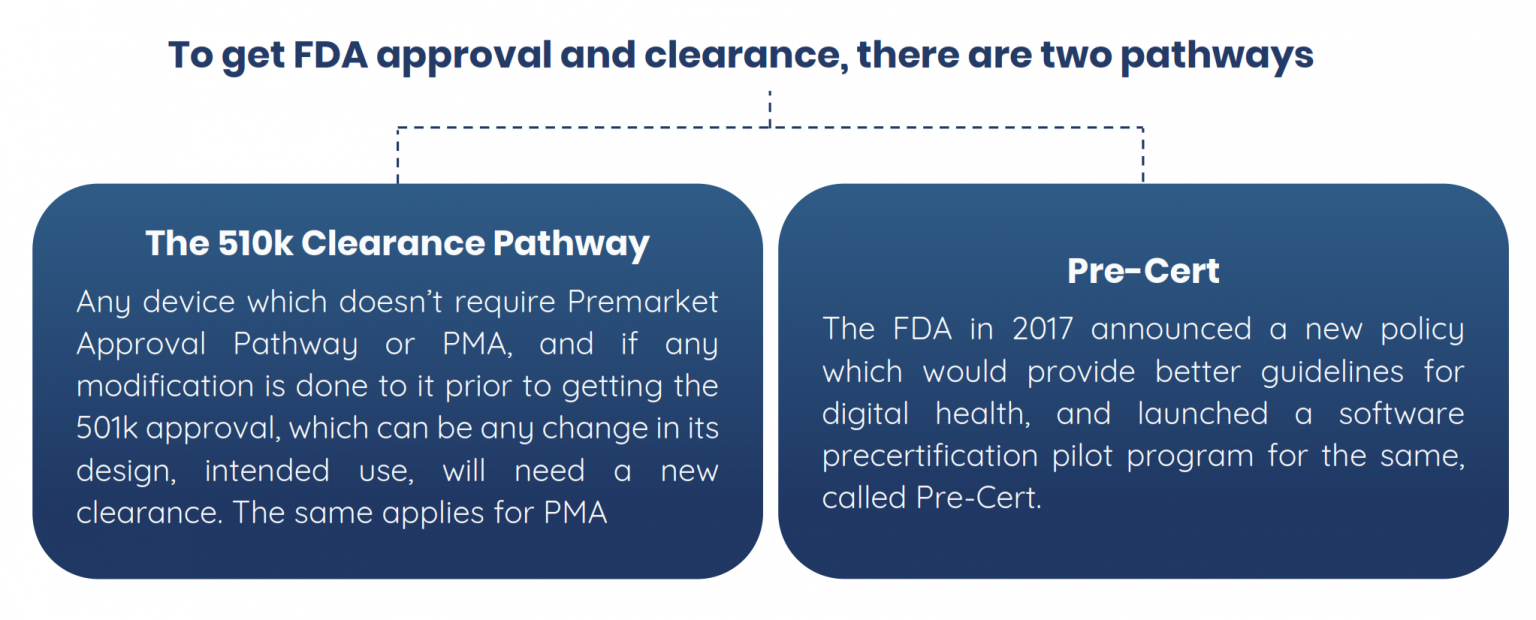

Devices related to digital therapeutics are divided into three classes, namely

Some successful FDA approvals that have come this way are as follows: Pear is a digital therapeutics startup which received FDA approval for its app Somryst, to manage older patients with chronic insomnia.

When it comes to defining the digital therapeutics solutions, there is the example of Apple Inc, which is a multinational organisation that produce wearable devices among other things, and there are services and software apps available to improve patient costs. These apps and the software itself are used by a number of healthcare professionals. This is known as Full-scale Market Attributes. When it comes to Pure Play Attributes, these are done through pharmaceutical partners, which will augment current pharmaceutical solution through addition of a software component or becoming part of pharma-based platform. It will need a digital subscription and is reimbursable. A great example of this is Pear Therapeutics, which integrates clinically validated software apps with previously approved treatment modules.

Challenges and Risks

All these minefields of data also have threats and risks posed to them

Cybersecurity

Data breaches can cost companies billions of dollars of revenue losses, and their stakeholders would suffer as a consequence. Cybercrime is a threat to patients’ medical data, and this is a serious breach of trust on a healthcare company’s part.

Tech Knowledge

The primary challenge of an online healthcare service is that the patient must be tech savvy enough to understand and navigate through the platform, while the platform itself must be able to handle large traffic and run without glitches. Trained medical staff that can handle this new form of patient care must be put in place to make the service a success.

New Rules

The changing nature of oversight and review boards is another challenge. The new laws and regulations that need to be adhered to, by healthcare startups in order to stay afloat and relevant in the market.

Chronic diseases management presents a significant opportunity

Managing chronic conditions is tricky via traditional delivery channels as it causes a drain on the money required to manage them. Monitoring through digital therapeutics can bring down costs for insurance companies that deal in management of acute problems.

However, a different picture comes to light in underdeveloped nations where people typically resort to traditional therapies. Lack of information, inadequate implementation of such digital schemes, and lack of promotion of these platforms adds to the problem. Also, a 2016 research by Savvy Cooperative suggests that a general concern of one-third of patients using digital therapeutics is that their information might be sold to third parties by tracking their behavior in invasive ways. However, there is a scope for growth and investment in this sector in Asia-Pacific and LAMEA as more people adopt smartphones, become aware of the benefits of digital health, and the lucrative side of availing treatments online rather than at a pricey hospital set up.

Chronic disease will continue to lead the DTx market

Healthark internal analysis has identified two conditions as the top investment pockets:

Diabetes

- With the rise of diabetes, it takes up a market share of 24% in 2020, and will be the highest revenue generator in digital therapeutics by 2027

- This trend is observed as in 2018, 10.5% of the American population was suffering from diabetes and was the 7th leading cause of death

- Currently, there are 425 million diabetics around the world, and this number will reach 625 million by 2045

- In 2016, 1.6 million people had lost their lives due to diabetes, according to data put forth by WHO. Along with all these, the cost of treating diabetes has also gone up by 26% since 2012

- Some big names already in the diabetes management sector are Noom, WellDoc, Glooko, and Omada Health. They are providing customers with software apps and programs to handle and monitor their diabetes.

Obesity

- Obesity, will take up a market share of 24% by 2027, and will see a growth of 23.2% between 2019-2027

- The prevalence rate for this disease indication has increased to 42.4% from 2017 to 2018 and it is the second most prevalent chronic disease after diabetes.

- In 2018 it was shown that among adults aged 20-39, obesity was 40%, and 44.4% in adults aged 40-59 years, and at a whopping 42.8% among adults aged 60 and older

- This condition also provides opportunities for prevention by usage of digital therapeutics, by tracking and monitoring lifestyle, and daily exercise along with intake of healthy food. In a 2017 analysis by Noom, it was found that 78% of the users would download it for losing weight (Noom Weight Loss Coach)

North America will dominate the DTx market for the next decade

North America contributes to 49% share of the digital therapeutics market as of 2020, and will be growing at a CAGR of 19.2% during 2019-2027. Even through Asia-Pacific is expected to grow at the highest rate, North America will still hold the majority of market share in the forecasted period. These trends are observed because the US led FDA has put in place strong guidelines to oversee the digital therapeutics market, establishing standards for the product quality before it hits the market.

This increases the product reliability and efficacy. There has also been a rise in chronic diseases burden in North America, with 6 in 10 adults having 2 or more chronic disease in the USA. There is also a need to bring down healthcare costs as 84% of the management money is directed towards treatment of chronic diseases, making up 19.9% of the country’s GDP. This price will only rise in the future with increasing burdens of chronic disease. There is also a positive shift towards reimbursement for digital therapies, showing that 25% of organisations already cover digital Tx, and 45% more are interested in covering for this in the future. The two major PBMs which are CVS Caremark and Express Scripts, together make up 53% of the reimbursement market, and have made adaptations to include DTx in their plans.

STRATEGIC STEPS FOR BUILDING A DIGITAL THERAPEUTICS SOLUTION

In order to better allow the digital therapeutics to flourish, awareness of this service must be made clear to both the patient and the provider, through social media, word of mouth, research and more. Development of a business model is necessary which can be tailor made for the specific client, along with investments needed in specific areas: in order to expedite your product launch, it is important to get into partnerships and joint ventures, acquisition. Also, a company may need to license and integrate multiple digital therapeutics products to complement an existing treatment by developing its own platform.

Authors

Healthark insights

Healthark insights

Contributors

Healthark insights

Healthark insights

Healthark insights

Sources

- Difference between digital health, digital medicine, and DTx products – Journal of family medicine and primary care

- Digital Health, Digital Medicine, Digital Therapeutics (DTx): What’s the difference? – Healthxl

- Digital Health Whitepaper – Capgemini

- Digital Transformation in Healthcare in 2021 – Digital Authority Partners

- Digital Therapeutics report – Allied market research

- Digital therapeutics Funding – FCA Ventures

- Top DTx moments 2020, 2019 – DTx East

- The Digital Therapeutics Revolution – Pitchbook

- Digital Health Software Precertification – FDA

- Startups in Digital Therapeutics – Tracxn

- Digital therapeutics still have a long road ahead of them – MobiHealthnews

Kindly fill in the following details. The report will be mailed to you.